Identify risks

Insurance

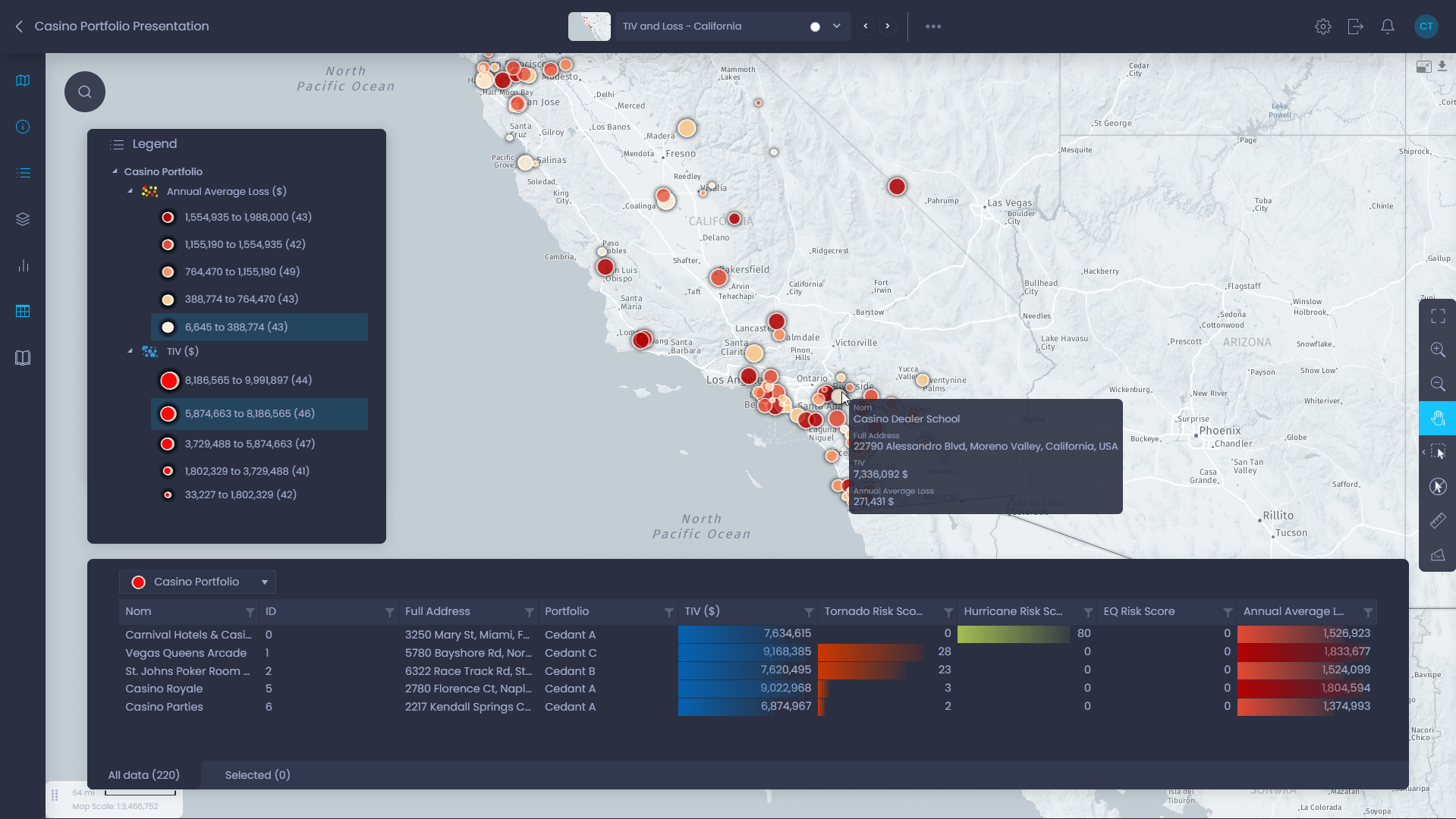

Underwriters and actuaries in the property and casualty insurance industry need to identify risk areas, improve the underwriting process, and improve analytical capabilities using geographic information. Risk management and access to data are at the heart of the actuarial problem. With CartoVista, overlaying risk areas—flood, hurricane tracks, earthquakes—with your own location data is simple.

CartoVista empowers you to

- Share insurance portfolio data online easily

- Integrate strategic earth observation data for catastrophe planning and response

- Improve the underwriting process with modeling data (USGS, HU tracks, FEMA flood maps, RMS, AIR, Verisk)

- Configure and communicate risk information visually and make better business decisions

- Be up and running in as little as one hour, with no IT support

More than 75% of the financial services and insurance industry rate location intelligence as either very important or critical to their success”

CartoVista in action for insurance

Try our professional plan for free

Ready to get started ?

- No obligation. No credit required